Garuda Construction and Engineering IPO Analysis: Garuda Construction and Engineering Limited is set to launch its Initial Public Offering (IPO) with a total issue size of Rs. 264.10 crore. This IPO includes fresh issues worth Rs. 173.85 crore and an offer for sale of Rs. 90.25 crore. The subscription window will open from 8th October 2024 to 10th October 2024, and the company is expected to be listed on the stock exchange on 15th October 2024.

In this article, we’ll dive into the strengths and weaknesses of Garuda Construction’s IPO, analyzing what potential investors should consider before making a decision. Let’s explore the details!

About Garuda Construction and Engineering

Garuda Construction and Engineering Limited, established in 2010 and based in Mumbai, Maharashtra, focuses on civil construction for residential, commercial, industrial, and infrastructure projects. Initially, the company worked exclusively on in-house projects for its promoter group. However, it has since expanded, taking on contracts with third parties and aiming to grow its role as a developer in the industry.

Over the years, Garuda has successfully delivered various significant projects. In 2014, it completed the Golden Chariot Vasai Hotel & Spa, and in 2021, it finished the prestigious Delhi Police Headquarters, featuring twin 17-story towers. Today, Garuda is involved in multiple projects spanning residential, commercial, industrial, and infrastructure sectors.

Project List

Garuda Construction and Engineering Limited has an impressive track record of completing high-profile projects, including the construction of the Golden Chariot Vasai Hotel & Spa in the Mumbai Metropolitan Region. Additionally, the company undertook the renovation and refurbishment of the Golden Chariot Boutique Hotel in Andheri (East), Mumbai. Another notable project was Garuda’s involvement in the construction of the Delhi Police Headquarters, further solidifying its reputation in the construction industry.

Currently, Garuda is involved in a range of ongoing and upcoming projects. These include a turnkey contract for an Agro Processing Cluster in Jalore District, Rajasthan, and residential projects like Garuda Shatrunjay in Borivali West, Mumbai. The company is also engaged in industrial projects, including civil work for a hydro project with various components such as intake structures and surge shafts. This diverse portfolio highlights Garuda’s versatility and expertise across multiple sectors.

Industry Overview

Garuda Construction and Engineering Limited operates in India’s booming construction sector, the second-largest economic contributor after agriculture. In FY23, this sector accounted for 8.4% of the national Gross Value Added (GVA) and has demonstrated significant resilience, recovering from the COVID-19 impact in FY21. The construction industry witnessed a robust growth at a CAGR of 10.6% from FY18 to FY23, highlighting its capacity to bounce back.

The sector’s future looks promising, with projections indicating an expansion from ₹3,922 billion in FY23 to ₹6,494 billion by FY30, growing at a CAGR of 7.5%. This growth is fueled by increased government investments in infrastructure, with the sector expected to contribute 15% to India’s economy by 2030. Such a favorable environment presents immense opportunities for companies like Garuda Construction, positioning them for growth in the global construction market.

Financial Highlights

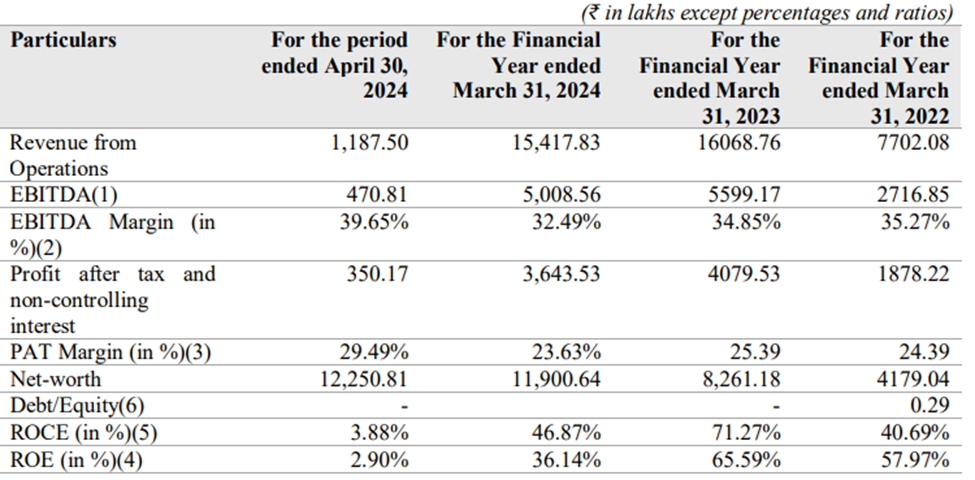

Garuda Construction and Engineering Limited has showcased remarkable financial growth in recent years. Its revenue from operations jumped from ₹77.02 crore in FY2022 to ₹154.18 crore in FY2024, achieving an impressive Compound Annual Growth Rate (CAGR) of 41.4%. Similarly, the company’s profit after tax saw a notable rise, increasing from ₹18.78 crore to ₹36.44 crore over the same period, with a CAGR of 39.29%.

Garuda has demonstrated strong operational efficiency, with its operating profit margin significantly outperforming its peers in the construction sector. In FY23, the company achieved an impressive 34.80% margin, more than double the peer average of 16.90%. Over the past three years, Garuda’s average margin stood at 30%, showcasing its consistent ability to exceed the industry average of 15%.

However, a notable portion of Garuda’s projects, around 35.39%, are linked to Group Companies and Promoter-related entities, reflecting a reliance on intra-group contracts. Despite this, the company is making strides toward diversification, with 64.61% of its current projects coming from unrelated external entities, signaling efforts to broaden its project base. Looking ahead, Garuda is expanding its scope by venturing into new construction segments, including joint development in residential projects and industrial ventures such as dam construction. While these strategic moves are set to enhance its expertise and client base, they also come with risks, including the potential for delays or underperformance due to the company’s limited experience outside its established group-related projects.

Competitors

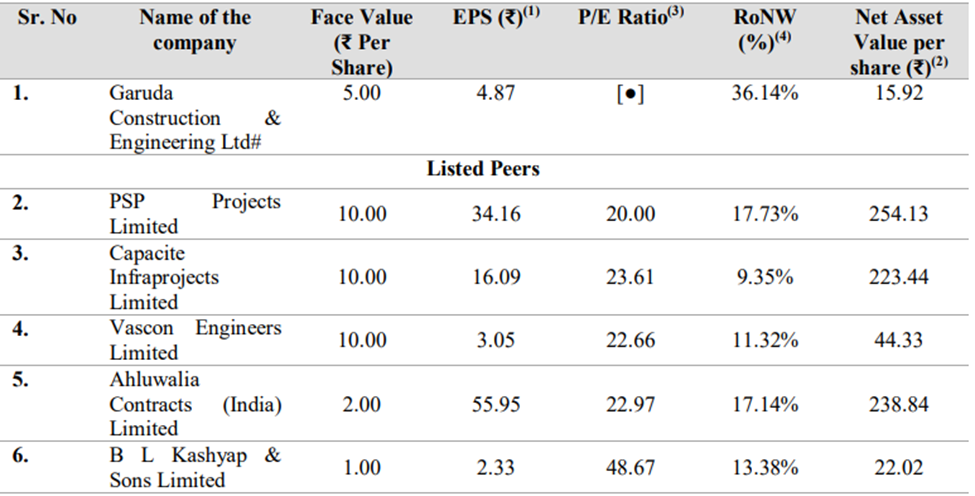

Garuda Construction and Engineering Limited faces competition from companies such as PSP Projects Limited, Capacite Infraprojects Limited, Vascon Engineers Limited, Ahluwalia Contracts (India) Limited, and BL Kashyap & Sons Limited. Although its face value per share is lower than most of its peers, Garuda Construction stands out with a notably higher return on net worth at 36.14%.

The images below highlight the comparison of Garuda Construction and its peer competitors:

Strengths

- Focused business approach: Specializes in civil construction of residential and commercial buildings, developing core competencies and technical expertise.

- Proven track record: Successfully completed diverse projects, including hospitality and residential buildings in the MMR region.

- Strong project management: Prioritizes timely completion and high-quality construction using an asset-light model for equipment deployment.

- Robust financial performance: Consistent growth in revenue, EBITDA, and profit after tax, with an improvement in interest coverage ratio from 13.0x in FY22 to 146x in FY23.

- Experienced leadership: Led by promoter Pravin Kumar Agarwal, who has over 20 years of business experience, supported by a skilled management team.

- Growing order book: Ongoing and upcoming projects worth ₹1,40,827.44 lakhs as of the RHP filing, reflecting strong growth potential.

Weaknesses

- Raw material price sensitivity: Prone to fluctuations in material costs, which may affect project profitability.

- Regulatory delays: Faces potential setbacks in obtaining necessary clearances, impacting project timelines.

- Intense competition: Operates in a highly competitive sector, making contract acquisition and market share retention difficult.

- Scaling challenges: Experiences complexities in scaling project execution and managing larger projects effectively.

- Contractual obligations: Needs to meet contractual requirements consistently to avoid penalties and protect reputation.

- Real estate market risks: May face challenges in flat saleability and land acquisition, especially in volatile markets.

- Regulatory impact: Susceptible to changes in real estate regulations, which may influence project viability and compliance costs.

GMP

As of October 3, 2024, Garuda Construction and Engineering Limited’s shares were trading in the gray market at a 0% premium, priced at Rs 95. This reflects no premium over the cap price of Rs 95, resulting in a premium of Rs 0 per share.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs 264.10 crore |

| Fresh Issue | Rs 173.85 crore |

| No of Shares | 2.78 crore |

| Opening date | October 8, 2024 |

| Closing date | October 10, 2024 |

| Face value | ₹5 per share |

| Price band | ₹92 to ₹95 per share |

| Lot size | 157 Shares |

| Minimum Lot Size | 1 (157 Shares) |

| Maximum Lot Size | 13 (2041 Shares) |

| Listing date | October 15, 2024 |

Promoters: Pravinkumar Brijendra Kumar Agarwal, PHK Ventures Limited and Makindian Township Private Limited

Book Running Lead Manager: Corpwis Advisors Private Limited

Registrar to the Offer: Link Intime India Private Limited

Conclusion

In conclusion, Garuda Construction and Engineering Limited emerges as a strong contender in the construction and infrastructure sector, specializing in civil construction for residential, commercial, and industrial projects. Its diverse project portfolio addresses critical areas such as real estate and public infrastructure. With a strong domestic base and ambitions for a more significant role as a developer, Garuda is well-equipped for growth.

Additionally, the company’s commitment to timely project completion and high-quality construction—demonstrated through its effective project management and asset-light approach—strengthens its competitive edge. While Garuda faces challenges such as sensitivity to raw material prices and regulatory delays, its strategic expansion into new construction sectors and solid financial performance help mitigate some of these risks. The experienced leadership team and expanding order book further suggest promising prospects for the future.

Overall, the IPO presents an opportunity for investors to engage in India’s rapidly growing infrastructure and construction market. However, it is essential to consider that Garuda’s entry into unfamiliar areas may entail certain risks. Nevertheless, its robust financial growth and strong market standing make it an appealing option.