Godavari Biorefineries Limited IPO Analysis: Godavari Biorefineries Limited is set to launch its IPO with a total size of Rs. 554.75 crore. The offering includes fresh shares worth Rs. 325 crore and an offer-for-sale of Rs. 229.75 crore. The IPO will open for subscription on October 23, 2024, and close on October 25, 2024, with the listing scheduled for October 30, 2024. In this article, we’ll dive into an analysis of the Godavari Biorefineries Limited IPO. Let’s get started!

About Godavari Biorefineries Limited

Godavari Biorefineries Limited, established in 1956, is a prominent manufacturer of ethanol-based chemicals in India. The company operates an integrated biorefinery with a production capacity of 570 KLPD of ethanol as of June 30, 2024. It is recognized as the largest global producer of MPO and the only Indian manufacturer of bio ethyl acetate.

The company offers a diverse range of bio-based chemicals, sugar, ethanol, and power. These products serve various industries, including food, beverages, pharmaceuticals, flavors, fragrances, fuel, cosmetics, and personal care. With clients in over 20 countries such as Australia, China, Germany, Japan, and the United States, Godavari Biorefineries has a strong international presence.

Godavari Biorefineries operates two manufacturing units in Bagalkot, Karnataka, and Ahmednagar, Maharashtra, employing 1,583 permanent staff, including 52 dedicated research professionals. As of October 2024, the company has secured 18 patents and holds 53 product registrations across several countries.

Financial Highlights

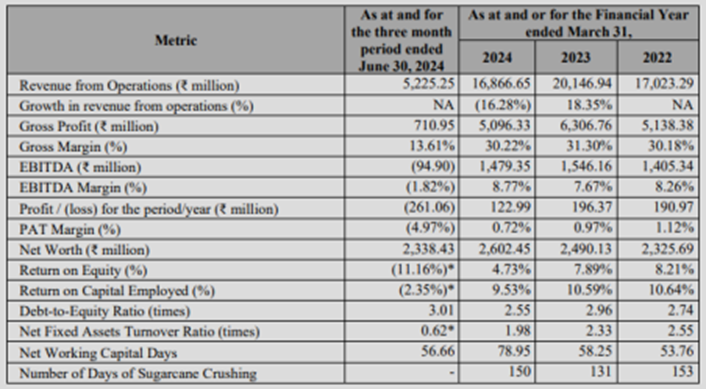

Godavari Biorefineries Limited experienced a notable decline in revenue in FY24, falling by 16.28% to Rs. 1,686.67 crore from Rs. 2,014.69 crore in FY23. The company generated Rs. 522.53 crore in revenue in Q1 of FY25. This downturn reflects challenges in the company’s financial performance during the fiscal year.

Breaking down revenue sources for FY24, sugar accounted for 33.42%, bio-based chemicals contributed 29.97%, the distillery segment provided 33.30%, cogeneration represented 2.54%, and unallocated revenue stood at 0.76%. Geographically, 83.35% of the company’s revenue came from India, while 16.65% originated from international markets.

The company’s net profit also saw a significant decrease of 37.37%, dropping from Rs. 19.64 crore in FY23 to Rs. 12.3 crore in FY24. For Q1 FY25, Godavari Biorefineries reported a net loss of Rs. 26.11 crore, indicating further challenges in maintaining profitability.

Despite these setbacks, Godavari Biorefineries managed to improve its EBITDA margin, which increased from 7.67% in FY23 to 8.77% in FY24. However, the PAT margin declined slightly from 0.97% to 0.72% during the same period, reflecting pressure on overall profitability.

In terms of returns, the company reported an ROE of 4.73% and an ROCE of 9.53% for FY24. Additionally, the company’s total borrowings increased from Rs. 654.06 crore in March 2024 to Rs. 693.70 crore by June 2024, signaling a rise in its debt levels.

Client Base

Godavari Biorefineries Limited serves an impressive client base that includes renowned companies such as Hershey India Pvt Ltd, Hindustan Coca-Cola Beverages Private Limited, Karnataka Chemical Industries, Techno Waxchem Pvt Ltd, LANXESS India Private Limited, IFF Inc., Ankit Raj Organo Chemicals Limited, Escorts Chemical Industries, Khushbu Dye Chem Pvt Ltd, Privi Speciality Chemicals Limited, Shivam Industries, along with leading oil marketing companies.

Competitors

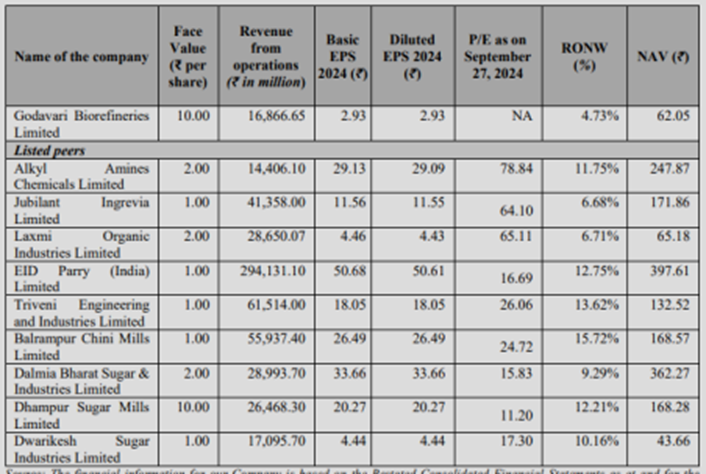

Godavari Biorefineries Limited’s key competitors include Alkyl Amines Chemicals Limited, Jubilant Ingrevia Limited, Laxmi Organic Industries Limited, EID Parry (India) Limited, Triveni Engineering and Industries Limited, Balrampur Chini Mills Limited, Dalmia Bharat Sugar & Industries Limited, Dhampur Sugar Mills Limited, and Dwarikesh Sugar Industries Limited. The images below present a comparison of these peer competitors with Godavari Biorefineries Limited.

Strengths

- The company produces a diverse range of products, including ethanol, chemicals, and power.

- Bio-chemicals, particularly bio-ethyl acetate, are key contributors to its revenue.

- Godavari Biorefineries Limited has a long-standing reputation, building trust among customers and investors.

- The company’s wide product range serves multiple industries, offering stability against market shifts and various revenue streams.

- Godavari Biorefineries exports to over 20 countries, with 17% of FY 2023 revenues coming from international markets.

- The company leverages the Somaiya Group’s 80+ years of experience, with leadership anticipating trends and driving expansions.

Weaknesses

- Limited domestic and international presence restricts market access and growth potential.

- Complex biorefinery processes lead to higher production costs, affecting profitability and pricing compared to traditional fuels.

- Raw material price fluctuations create operational instability, exposing the company to supply chain disruptions and market volatility.

- Reliance on agricultural inputs makes the company vulnerable to climate-related disruptions, impacting production and supply chains.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs 554.75 crore |

| Fresh Issue | Rs 325.00 crore |

| Offer for Sale (OFS) | Rs 229.75 crore |

| No of Fresh Shares | 0.92 crore |

| No of OFS shares | 0.65 crore |

| Opening date | October 23, 2024 |

| Closing date | October 25, 2024 |

| Face value | ₹10 per share |

| Price band | ₹334 to ₹352 per share |

| Lot size | 42 Shares |

| Minimum Lot Size | 1 (42 Shares) |

| Maximum Lot Size | 14 (546 Shares) |

| Listing date | October 30, 2024 |

Promoters: Samir Shantilal Somaiya, Lakshmiwadi Mines and Minerals Private Limited, Sakarwadi Trading Company Private Limited, and Somaiya Agencies Private Limited

Book Running Lead Manager: Equirus Capital Private Limited, SBI Capital Markets Limited

Registrar to the Offer: Link Intime India Private Limited

Conclusion To sum up, Godavari Biorefineries Limited aims to raise funds through its IPO, with a focus on ethanol-based production. While the company has stable financials, the recent dip in revenue is a point of concern. However, its diverse product portfolio, particularly in bio-based chemicals, enhances its growth potential. The IPO seeks to leverage the growing demand for ethanol, positioning the company as a key player in the sector.