Bansal Wire IPO Analysis: Bansal Wire Industries Limited is set to launch its Initial Public Offering, with subscriptions opened on July 3, 2024, and closing on July 5, 2024. This article provides an in-depth review of the Bansal Wire Industries Limited IPO 2024, examining its strengths, weaknesses, financials, and GMP (Grey Market Premium). Stay tuned for more details!

About Bansal Wire

Bansal Wire Industries Limited (BWIL) was established on December 11, 1985, specializing in the production of a diverse range of wires catering to sectors such as power, automotive, infrastructure, agriculture, consumer durables, and general engineering. Their product line includes high and low-carbon steel wires, galvanized wires, cable armoring wires and strips, stainless steel wires, profile and shaped wires, and specialty wires, each serving a wide array of applications.

BWIL holds the distinction of being India’s largest manufacturer of stainless steel wires and the second largest producer of steel wires by volume. In the fiscal year 2023, the company achieved production volumes of 72,176 metric tonnes per annum (MTPA) for stainless steel wire and 206,466 MTPA for steel wire, capturing approximately 20% and 4% of the respective market shares.

The company caters to a wide range of customer demands with a portfolio exceeding 3,000 distinct stock-keeping units, a breadth unparalleled among steel wire manufacturers in India. These sizes span from an ultra-thin 0.04 mm to a robust 15.65 mm, ensuring comprehensive coverage of market requirements.

Customer Base

Bansal Wire Industries Limited boasts a robust customer base exceeding 5,000 clients spanning a wide array of industrial sectors. This broad clientele contributes to the company’s diversified portfolio, ensuring that no single customer or sector dominates its sales. In the fiscal year spanning 2021 to September 30, 2023, no individual customer accounted for more than 5% of total sales, and no single sector or segment contributed more than 25%.

Moreover, Bansal Wire Industries Limited has consistently achieved high customer retention rates, maintaining an average retention ratio of 89.22% among its top 300 clients. These top customers consistently contributed significantly to the company’s sales, accounting for 76.80%, 78.22%, and 78.20% of total sales in the fiscal years 2021, 2022, and 2023, respectively.

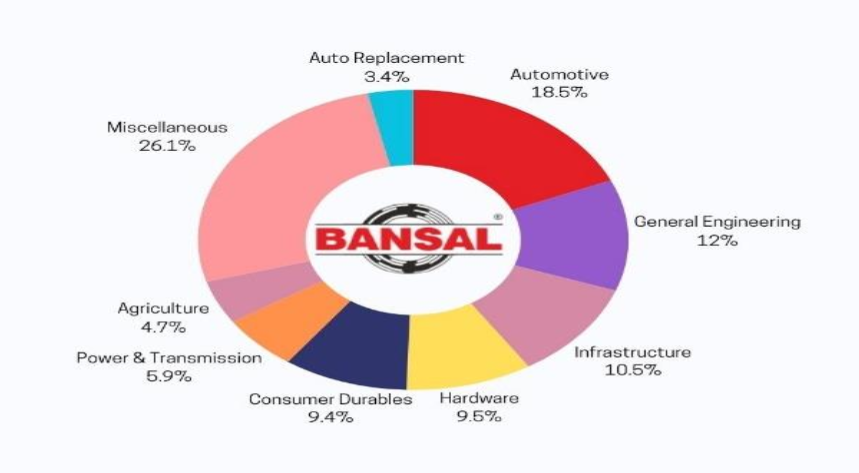

With a legacy spanning 38 years, Bansal Wire Industries Limited has built a diversified portfolio catering to a spectrum of industries. These include automotive, general engineering, infrastructure, hardware, consumer durables, power and transmission, agriculture, and auto replacement, reflecting the company’s adaptability and broad market presence.

The chart will illustrate the varied range of products offered by Bansal Wire Industries.

Source: RHP of the Company

Industry Overview

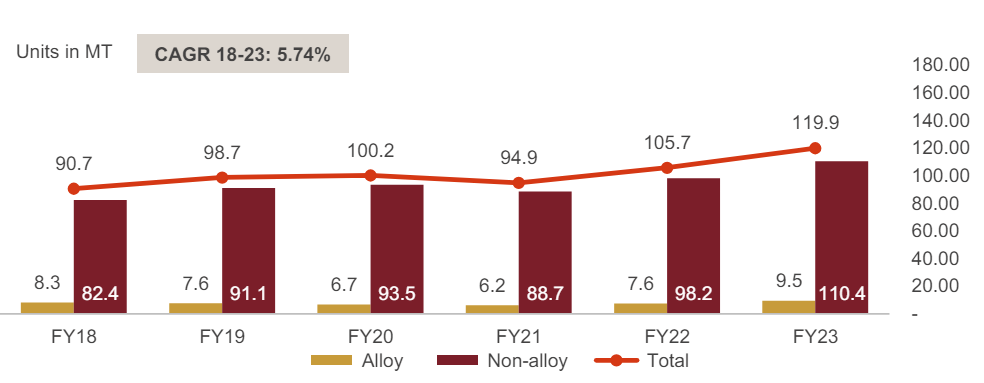

India has maintained its position as the world’s second-largest steel producer since 2018. The Indian steel industry exhibited substantial growth with a compounded annual growth rate (CAGR) of 5.74% from fiscal year 2018 to 2023, expanding from 90.72 million tonnes (MT) in FY18 to 119.90 MT in FY23. However, this growth trajectory was impacted by market volatility experienced during the pandemic.

Source: RHP of the Company

Steel demand in India exhibited robust growth, expanding by 11.4% in FY22 and further accelerating to 13.08% in FY23. Projections for FY24 anticipate a continued strong growth trajectory of 10-12%, underpinned by government infrastructure investments, robust demand from the automotive sector, and consumer goods sector expansions. Looking ahead, steel demand in India is forecasted to maintain a compound annual growth rate (CAGR) close to 7% until fiscal year 2027, with production expected to reach between 155-160 million tonnes (MT).

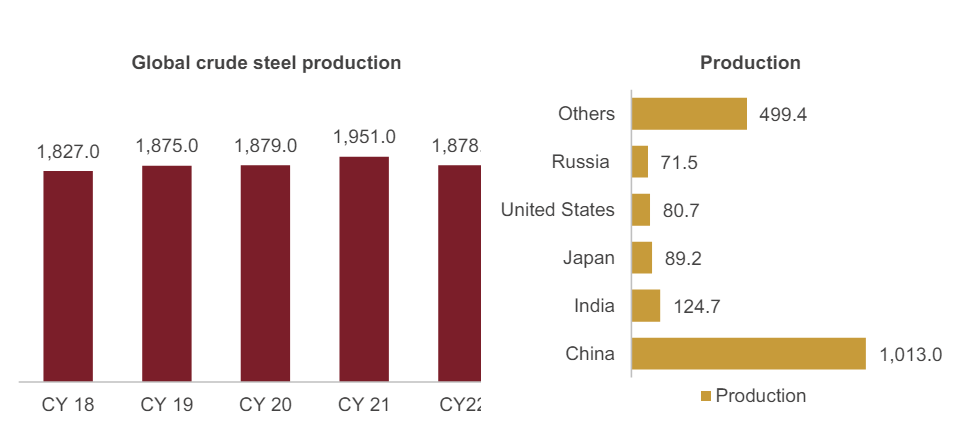

In contrast, global crude steel production experienced a more modest increase from 1827 MT in 2018 to 1878 MT in 2022, growing at a CAGR of 0.70%. India’s crude steel production, however, outpaced the global average with a CAGR of 4.02% over the same period, underscoring its significant role in the global steel market landscape.

Source: RHP of the Company

Financial Highlights

Source: RHP of the Company

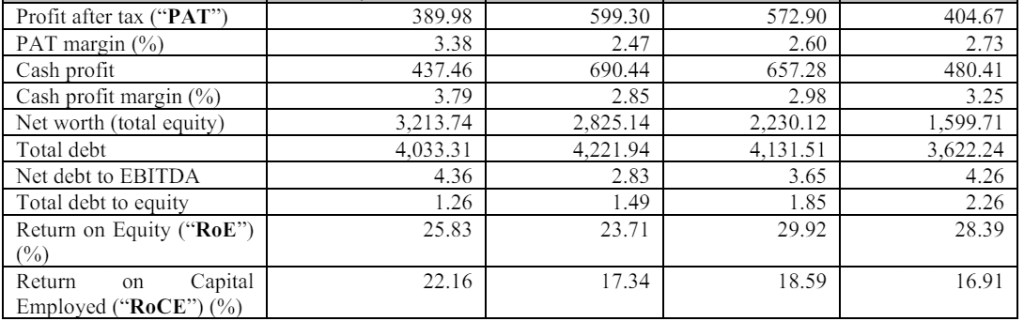

Bansal Wire Industries has shown significant financial growth, with total revenue increasing markedly from 2205.07 crores in FY22 to 2422.57 crores in FY23, marking a growth of 9.86%. The company also saw a slight rise in net profit, climbing from 57.29 crores in FY22 to 59.93 crores in FY23.

In FY23, Bansal Wire Industries achieved an EBITDA margin of 4.73% and a net profit margin of 2.47%. For the first six months of FY24, the company reported revenues of 1154.03 crores and maintained a net profit of 39 crores. During FY23, Bansal Wire Industries reported a Return on Equity (ROE) of 23.71% and anticipates a Return on Capital Employed (ROCE) of 17.34%. The company’s debt-to-equity ratio stands at 1.49%, indicating higher debt relative to equity. However, there has been a reduction in the debt-to-quick ratio compared to the previous year.

Competitors

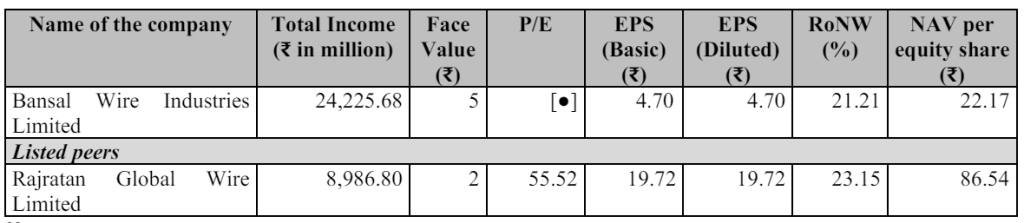

Rajratan Global Wire Limited stands as a peer competitor to Bansal Wire Industries Limited. Listed on the stock market, Rajratan Global Wire Limited reports a total revenue of 898.68 crores. Bansal Wire Industries surpasses the revenue of Rajratan Global Wire Limited’s peer competitors.

The following images display the comparison of peer competitors of Bansal Wire Industries Limited:

Source: RHP of the Company

Strengths

- Large Manufacturing Capacity: Bansal Wire operates from four current manufacturing facilities and is in the process of establishing the largest single-location steel wire manufacturing facility in Dadri, India, poised to be one of the largest in Asia.

- Diverse Product Range: Offering over 3,000 stock-keeping units (SKUs), Bansal Wire boasts the most extensive range among Indian steel wire manufacturers, catering effectively to a wide array of customer requirements.

- Flexible Production Capabilities: The company’s product mix and plant capabilities enable agile adjustments and expansions of production lines to align with dynamic industry demands, ensuring adaptability and responsiveness.

- Long-standing Customer Relationships: Maintaining a resilient business model, Bansal Wire ensures no single customer contributes more than 5% of total sales, while no individual sector or segment exceeds 25% of sales, fostering balanced and stable customer relationships.

- Export Revenue: With a substantial 14% share of total revenue from exports, Bansal Wire demonstrates a robust presence in international markets, enhancing its global footprint and revenue diversification.

- Financial Performance: Showing consistent sales and profitability growth, Bansal Wire has consistently outperformed many of its industry peers, reflecting strong financial health and strategic management.

Weaknesses

- Technological Advancements: Relative to global competitors, the company may lag in adopting the latest technological innovations, potentially affecting operational efficiency and product quality.

- Working Capital Requirements: The business necessitates substantial working capital to support its operations, particularly during phases of expansion or heightened demand.

- Dependence on Promoters: The company heavily relies on the active involvement and expertise of its promoters, posing a risk factor should key individuals become unavailable.

- High Competition: Operating in a fiercely competitive steel industry landscape with numerous established players, the company faces challenges in maintaining market share and profitability.

- Raw Material Volatility: Fluctuations in the prices of essential raw materials such as iron ore, wire rods, and other consumables significantly influence the company’s cost structure and profitability.

- Geopolitical Risks: Given its export-oriented revenue, the company is exposed to geopolitical uncertainties and currency fluctuations, which can impact profitability and market stability.

GMP

As of July 1st, 2024, Bansal Wire Industries’ shares commanded a 23% premium in the grey market, trading at Rs 316, which represents a Rs 60 premium over its upper cap of Rs 256 per share.

Key IPO Information

| Particulars | Details |

| IPO Size | ₹745.00 Cr |

| Fresh Issue | ₹745.00 Cr |

| No Of Shares | 2.91 crores |

| Opening date | July 3, 2024 |

| Closing date | July 5, 2024 |

| Face value | ₹5 per share |

| Price band | ₹243 to ₹256 per share |

| Lot size | 58 Shares |

| Minimum Lot Size | 1 (58 Shares) |

| Maximum Lot Size | 13 (754 shares) |

| Listing date | July 10, 2024 |

Promoters: Arun Gupta, Anita Gupta, Pranav Bansal and Arun Kumar Gupta HUF.

Book Running Lead Manager: SBI Capital Markets Limited, DAM Capital Advisors Limited

Registrar to the Offer: KFIN Technologies Limited

Conclusion This article delves into the specifics of the Bansal Wire Industries IPO 2024. Positioned as one of India’s leading steel wire manufacturers, Bansal Wire Industries underscores its growth strategy with ambitious plans, notably the construction of Asia’s largest single-location steel wire manufacturing facility in Dadri. The company’s robust financial performance, strategic expansion endeavors, and solid market standing present compelling reasons for investment. However, prospective investors should carefully evaluate its potential weaknesses to make a well-rounded investment decision.