Ixigo IPO Analysis: Travel broadens our horizons, enabling us to explore diverse cultures, landscapes, and experiences that expand our perspectives. This review examines the IPO of Ixigo, a leading online travel agency in India.

The IPO will be open for subscription from June 10, 2024, to June 12, 2024. In this article, we will analyze the Ixigo IPO Review 2024, covering its strengths, weaknesses, financials, and GMP. Keep reading to learn more!

About Ixigo

Founded in 2006, Ixigo (Le Travenues Technology) is an online travel agency (OTA) that allows travelers to book train, flight, and bus tickets, as well as hotel accommodations, through its platform under the “ixigo” brand.

Ixigo provides a comprehensive suite of services, including PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, alternative route or transportation planning, flight status updates, automated web check-in, bus running status, price and availability alerts, deal discovery, destination content, personalized recommendations, instant fare alerts for flights, AI-based travel planning, and automated customer support.

Ixigo’s range of OTA platforms includes:

- Ixigo Trains and Confirmtkt App: These apps facilitate travel planning and booking by allowing users to search for available train tickets across India, book and pay for tickets, receive tickets through various fulfillment methods, access real-time information on train arrivals and departures, and obtain necessary post-sales support.

- Ixigo Flights Mobile App: This app enables users to search and book air tickets, train tickets, buses, and hotels. Users can access past and future bookings, modify booking details, and request e-tickets and information via messaging platforms.

- Abhibus App: This app lets users check bus amenities, compare booking prices, view bus schedules on their desired routes, and access other facilities.

According to data.ai in September 2023, Ixigo leads in app usage among OTAs, boasting a cumulative 83 million monthly active users across its platforms.

Recently, Ixigo launched ixigo PLAN, an intelligent travel planner powered by AI. This innovative tool helps travelers create detailed itineraries and access real-time destination information. Additionally, the company introduced a generative AI plugin, enhancing ixigo PLAN with conversational interaction capabilities.

Ixigo has also introduced a new service called ixigo Assured Flex. This service allows customers to purchase fully flexible air or rail tickets without extra charges for cancellation or rebooking (excluding price differences) for all domestic flights and rail bookings, all at an affordable price.

Industry Overview

According to the World Travel & Tourism Council (“WTTC”), travel and tourism expenditure in India reached ₹ 16.5 trillion in Fiscal 2023, constituting 9.7% of the country’s GDP. This contribution is expected to witness substantial growth in the foreseeable future, encompassing various expenses such as transportation, accommodation, cultural activities, sports, recreation, entertainment, retail, food and beverage, as well as visitor exports, by both residents and visitors.

Presently, the Indian travel and tourism market, including air, road, and hotel sectors, stands at approximately ₹ 3,808 billion, with projections indicating a CAGR of 9%. By Fiscal 2028, this market is anticipated to reach ₹ 5,904 billion.

Furthermore, the accelerated digitization of inventory, notably due to the COVID-19 pandemic, has resulted in a surge in online bookings across all travel modes. The online travel industry is forecasted to expand by 13%, primarily driven by growth in the online bus segment at 18% and the air segment at 15%.

In Fiscal 2023, the railway sector led in online booking penetration among all travel sectors in India, with 81% of reserved train tickets being booked online. Meanwhile, 70% of air travel bookings were conducted online during the same period. However, online penetration for hotel bookings remained modest at 32%, with only 19% of bus bookings being made online.

Financial Highlights

Looking at the financials of Ixigo (Le Travenues Technology), it’s evident that its revenues experienced a substantial surge, climbing from ₹138.41 crores in FY21 to ₹517.57 crores in FY23.

Similarly, Ixigo’s profits also saw a significant increase, rising from ₹7.53 crores in FY21 to ₹23.40 crores in FY23. However, the company incurred a loss in FY22 due to a sharp rise in its expenses.

In the first nine months of FY24, the company’s revenues and net profits reached ₹678.71 crores and ₹65.71 crores, respectively, surpassing the entire earnings of FY23.

Furthermore, it’s noteworthy that the company has no long-term borrowings, providing it with ample leverage to explore debt funding opportunities in the future.

Competitors

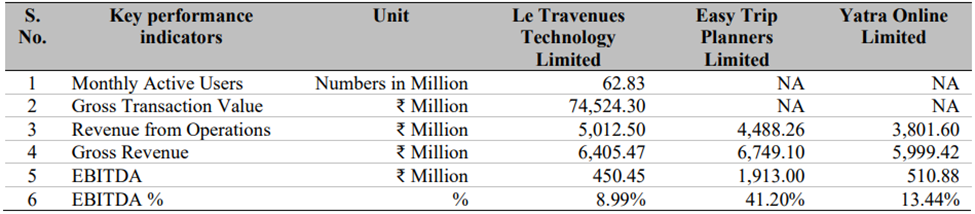

Within the industry, notable listed peers include Easy Trip Planner and Yatra Online. The image below presents the Key Performance Indicators of the company alongside its listed industry peers:

Source: RHP of the company

Strengths

- In the fiscal year 2023, Ixigo and ConfirmTkt jointly held a 51% market share in rail bookings among online travel agencies (OTAs). Additionally, in the first half of fiscal year 2024, they secured a 5.2% share of the total OTA airline market volume. Moreover, Abhibus claimed a 12.5% market share in the first half of FY24, positioning it as the second-largest OTA in India.

- The company utilizes artificial intelligence, data science, and machine learning to transform travel data and user-generated information into valuable business insights, enhancing its travel services and optimizing operations. Leveraging open-source technologies helps lower the total cost of infrastructure ownership, while selective software adoption ensures incremental expenditure as user base and queries grow.

- For cost-efficient online marketing, the company employs strategies like search engine optimization, app store optimization, and paid search engine marketing, focusing on enhancing search engine rankings and app store visibility organically through quality content, thus improving user ratings and reviews of its OTA platforms.

- With a comprehensive mix of product and service offerings spanning trains, flights, buses, and hotels, the company caters to the online travel market in India, enabling monetization across all facets of its OTA platforms.

Weaknesses

- The provision of train ticketing services relies on the company’s agreement with IRCTC. Should this agreement be terminated, the company may be unable to offer train ticketing services, potentially impacting its operations negatively.

- The company’s primary objective is to expand its customer base through sales and marketing initiatives. However, the associated costs have been steadily increasing, and there is no assurance that these expenses will be commensurate with the number of customers acquired.

- Revenue generation for the company primarily stems from commissions, incentives, and other forms of compensation received from its travel suppliers. Any reduction or cessation of these compensations could have adverse effects on the company’s operations.

- The company’s business heavily relies on its relationships with a wide array of travel suppliers. Any unfavorable alterations in these relationships or an inability to forge new ones could detrimentally affect the company’s operations.

- Significant operational services for the company are provided by third-party service providers. Any failure on their part to meet the company’s requirements could disrupt its operations.

GMP

On June 6, 2024, Ixigo’s shares traded at a premium of 32.26% in the grey market, reaching Rs. 123 per share. This represents a premium of Rs. 30 per share over the cap price of Rs. 93.

Key IPO Information

| Particulars | Details |

| IPO Size | ₹ 740.10 Cr |

| Fresh Issue | ₹ 120.00 Cr |

| Offer for sale (OFS) | ₹ 620.10 Cr |

| Opening date | June 10, 2024 |

| Closing date | June 12, 2024 |

| Face value | ₹ 1 per share |

| Price band | ₹ 88 to ₹ 93 per share |

| Lot size | 161 Shares |

| Minimum Lot Size | 1 |

| Maximum Lot Size | 13 (2093 shares) |

| Listing date | June 18, 2024 |

Book Running Lead Manager: Axis Capital Limited, DAM Capital Advisors Limited, JM Financial Limited

Registrar to the Offer: Link Intime India Private Limited

Conclusion

In this article, we delve into the details of the Ixigo IPO Review 2024. The company boasts a dominant market share in rail bookings and is steadily expanding its presence in airline and bus bookings. With its extensive product offerings, utilization of AI and data analytics, and implementation of cost-efficient marketing strategies, Ixigo demonstrates strong potential for growth in the online travel sector.

However, certain risks warrant consideration. These include the company’s reliance on IRCTC for train ticketing services, escalating costs associated with customer acquisition, dependence on commissions from travel suppliers, and potential disruptions stemming from third-party service providers. In conclusion, the Ixigo IPO presents an enticing investment opportunity within the rapidly evolving online travel industry. Nevertheless, investors are advised to conduct thorough assessments of both the risks and opportunities before making any decisions regarding participation in the IPO.