BLS E-Services Limited (BLSe), a provider of technology-enabled digital services, disclosed its audited consolidated financial results for the quarter and fiscal year ending March 31, 2024.

Mr. Shikhar Aggarwal, Chairman of BLS E-Services Ltd., expressed satisfaction with the company’s performance and recent developments. He highlighted the notable financial achievements in FY24, with Total Revenue and PAT showing robust growth of 25.7% and 65.0% respectively. Emphasizing the expansion of their reach, he mentioned surpassing 100,000 Touchpoints and establishing over 1,000 BLS Stores, aiming to enhance financial inclusion and digital empowerment.

Aggarwal underscored transformative initiatives across sectors, including collaboration with the National Health Authority for Ayushman Bharat Quality Check in Uttar Pradesh, under the National Digital Health Mission, which advances healthcare accessibility. He also mentioned partnerships with Public and Private Sector Banks, such as ‘Har Ghar Suraksha’ and ‘DSB Dastak’ campaigns, demonstrating their commitment to extending banking services to every doorstep.

Highlighting their operational achievements, Aggarwal noted facilitating over 133 million transactions worth more than Rs. 72,700 Crores through 21,000+ BC Centers. He also mentioned generating leads of over Rs. 580 Crores of loans & deposits quarterly for private sector banking partners through their Business Facilitator model, showcasing their competitive edge.

Looking ahead, Aggarwal emphasized expanding their network and reach through BCs and digital stores, alongside investments in building advanced digital infrastructure to accommodate the growing volume of transactions in the evolving economy. He expressed the company’s ambition to set new industry standards and contribute to a more equitable and sustainable future.

Q4FY24 Performance Snapshot

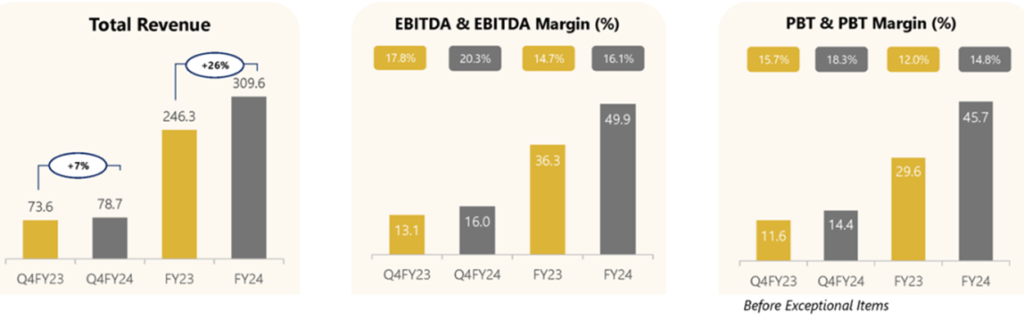

- Total Revenue increased by 25.7% YoY to Rs. 309.6 Crores (FY24) from Rs. 246.3 Crores (FY23).

- EBITDA rose by 37.6% to Rs. 49.9 Crores, with a margin of 16.1% (FY24) compared to 14.7% (FY23), expanding by 139 bps.

- PBT before exceptional items grew by 54.5% to Rs. 45.7 Crores (FY24) from Rs. 29.6 Crores.

- PAT increased by 65.0% to Rs. 33.5 Crores (FY24) from Rs. 20.3 Crores, with a PAT margin of 10.8% (FY24), up from 8.3% (FY23), expanding by 258 bps.

in Rs. Crores Consolidated Financials

Key Business Updates

- In February 2024, the company successfully completed its listing on BSE & NSE with a ~Rs. 300 Crores IPO.

- Net proceeds from the IPO will be used to:

- Strengthen the technology infrastructure

- Consolidate the existing platform

- Fund the setup of BLS Stores

- Pursue inorganic growth opportunities

- Collaboration with the National Health Authority for the Ayushman Bharat Quality Check (QC) in Uttar Pradesh under the National Digital Health Mission.

- Commencement of door-step banking services for the elderly population in 25 states/UTs.

- Business facilitation agreements with private banks HDFC, Kotak, and Karur Vysya Bank.

- Business correspondent RFP wins with Indian Overseas Bank, Indian Bank, Baroda Gujarat Gramin Bank, and Baroda Rajasthan Kshetriya Gramin Bank.

- Penetration in rural regions through various initiatives, including:

- CSP+ project covering 200+ gram panchayats in Orissa

- Initiation of Aadhaar demographic update service in Karnataka

- Expansion of assisted e-services with Hospicash & Wellness drive, enrolling over 22,000 customers.

- Launch of new product: Iris Scanner in Digital Store.

- Launch of BLS Store mobile application.

- Partnership with India Post Payments Bank (IPPB) through the Directorate of Electronic Delivery of Citizen Services (EDCS), E-Governance Department of Personnel and Administrative Reforms (DPAR), Government of Karnataka (GoK).

- Citizen enrolments for Gruha Jyoti (Free Electricity Services to Citizens) and Gruha Lakshmi (Financial Assistance to Women) schemes in Karnataka Grama One project.

- Initiation of loan and deposit sourcing for private sector banks (HDFC, Kotak) in the Business Facilitator (BF) model.

| Particulars (Rs Crores) | Q4FY24 | Q4FY23 | YoY | Q3FY24 | QoQ | FY24 | FY23 | YoY |

| Total Revenue | 78.7 | 73.6 | 6.9% | 72.8 | 8.1% | 309.6 | 246.3 | 25.7% |

| EBITDA | 16.0 | 13.1 | 21.8% | 11.5 | 39.1% | 49.9 | 36.3 | 37.6% |

| EBITDA Margin (%) | 20.3% | 17.8% | 248 bps | 15.8% | 452 bps | 16.1% | 14.7% | 139 bps |

| PBT before exceptional items | 14.4 | 11.6 | 24.6% | 10.5 | 37.2% | 45.7 | 29.6 | 54.5% |

| PBT Margin (%) | 18.3% | 15.7% | 260 bps | 14.4% | 388 bps | 14.8% | 12.0% | 275 bps |

FY24 versus Q4FY24

- Total Revenue:

- FY24: Increased by 25.7% YoY to Rs. 309.6 Crores (from Rs. 246.3 Crores in FY23).

- Q4FY24: Grew by 6.9% YoY to Rs. 78.7 Crores (from Rs. 73.6 Crores in Q4FY23).

- EBITDA:

- FY24: Increased to Rs. 49.9 Crores (up 37.6% from Rs. 36.3 Crores in FY23); EBITDA margin at 16.1% (up from 14.7% in FY23), expanded by 139 bps.

- Q4FY24: Increased to Rs. 16.0 Crores (up 21.8% from Rs. 13.1 Crores in Q4FY23); EBITDA margin at 20.3% (up from 17.8% in Q4FY23), expanded by 248 bps.

- PBT before exceptional items:

- FY24: Grew by 54.5% to Rs. 45.7 Crores (from Rs. 29.6 Crores in FY23).

- Q4FY24: Increased by 24.6% to Rs. 14.4 Crores (from Rs. 11.6 Crores in Q4FY23).

- PAT:

- FY24: Grew by 65.0% to Rs. 33.5 Crores (from Rs. 20.3 Crores in FY23); PAT margin at 10.8% (up from 8.3% in FY23), expanded by 258 bps.

About BLS E-Service

BLS E-Services, a subsidiary of BLS International, stands as a leading technology-enabled digital service provider in India, offering a diverse range of services including Business Correspondent (BC/Rural Banking Outlets) services, Assisted E-services, and E-Governance Services. These offerings are designed to empower communities at the grassroots level, revolutionizing how essential services are accessed.

Through its extensive network, BLS E-Services plays a crucial role in facilitating access to a wide spectrum of essential public utility services, social welfare programs, healthcare, finance, education, agriculture, and banking services. This comprehensive array of services caters to governments (G2C) and businesses (B2B), while also addressing the diverse needs of citizens (B2C) across urban, semi-urban, rural, and remote areas.

Operating within a unique integrated business model, BLS E-Services bridges the digital gap in areas with low internet penetration by offering solutions through a phygital strategy—combining physical and digital approaches. This strategy ensures that even in the most remote areas, essential services are accessible, thereby fostering inclusive growth and development.

BSE: 544107: NSE: BLSE. Website: www.blseservices.com